Introduction: The Great Jewelry Price Jump

If you’ve been shopping for jewelry lately, you’ve probably noticed that sterling silver chains, pendants, and bracelets suddenly feel more like luxury items than everyday essentials. No, you’re not imagining it. Jewelry prices in 2025 have skyrocketed compared to just a year ago — and we’ve done the research to back it up.

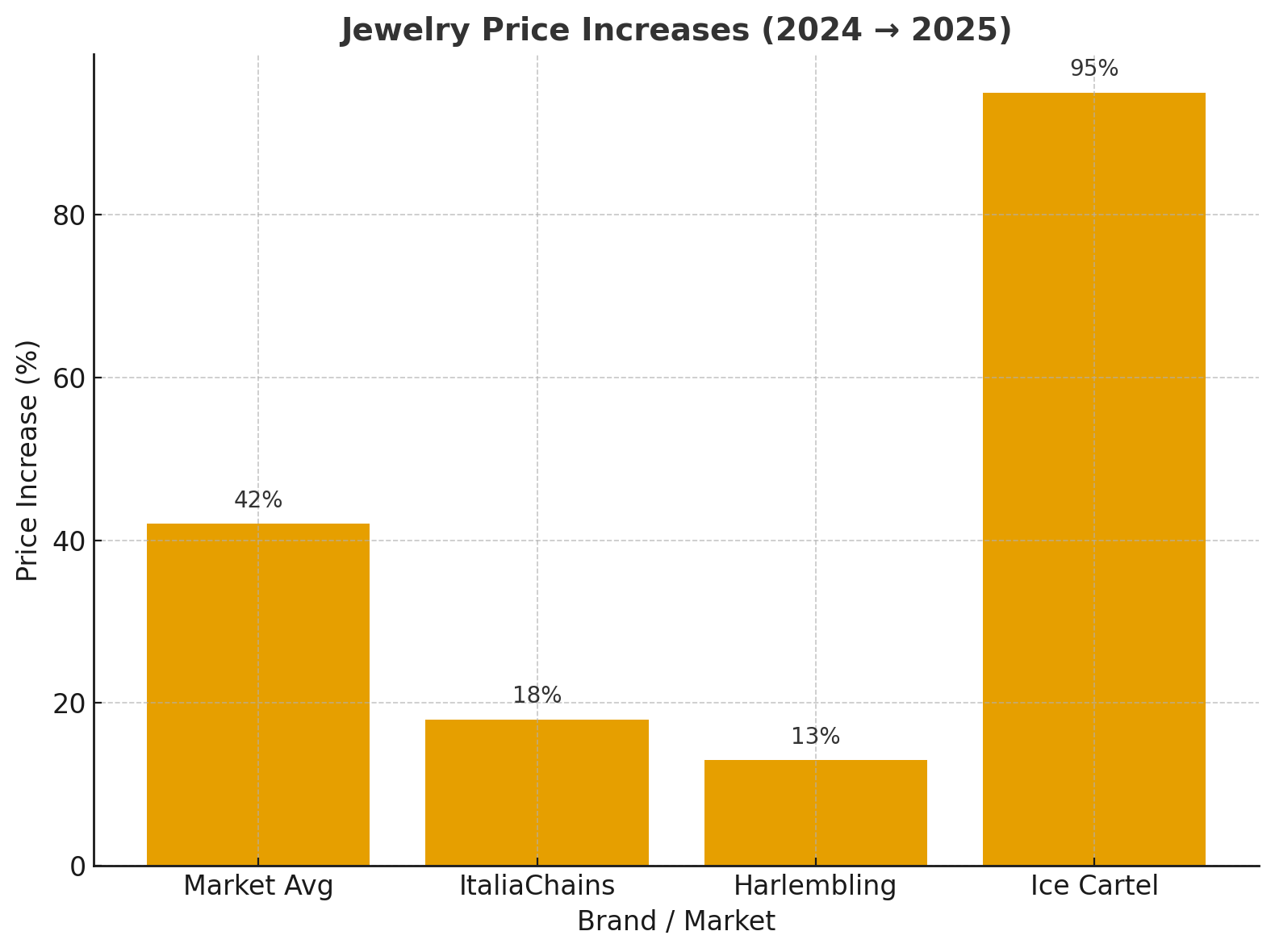

Our study analyzed 20 popular items across 110 jewelry companies that sell sterling silver jewelry, from independent U.S. brands to European manufacturers and Chinese exporters. The results? A jaw-dropping 42% increase in retail prices from 2024 to 2025.

Why? Two words: tariffs and silver.

Study Findings: A 42% Price Hike in Just One Year

Here’s what our analysis found when comparing identical jewelry pieces across the two years:

-

42% average price increase across 20 items (chains, pendants, earrings, bracelets).

-

Sterling silver spot price jumped nearly 50%, from ~$27/oz in 2024 to ~$40/oz in 2025.

-

Tariffs on Chinese imports tightened further, and surprise — new tariffs were added to Italian jewelry as well. Yes, the land of pasta and rope chains is paying the Trump tax now too.

Example:

-

A 5mm sterling silver Cuban chain that sold for $150 in 2024 now retails for $215 in 2025.

-

A sterling silver pendant that was $95 last year now averages $140.

But not all jewelers reacted the same way. Some shouldered the pain with their customers — while others saw dollar signs and went wild.

Why Prices Jumped: The Silver & Tariff Double Whammy

1. The Silver Price Surge

Silver prices hit $40/oz in 2025, up almost 50% from the previous year. For context, silver hasn’t been this expensive since the Hunt Brothers tried to corner the silver market in 1980. (Google it — it’s a wild story involving Texas oil billionaires, leverage, and a market collapse worthy of a Netflix documentary.)

Jewelers who rely on sterling silver (92.5% pure silver) simply can’t escape these costs. When the raw metal costs more, your favorite rope chain does too.

2. Tariffs, Tariffs, Tariffs (Thanks, Trump)

While tariffs on Chinese imports aren’t new, 2025 expanded tariffs to Italian jewelry as part of broader trade negotiations. That means even Italian-made sterling silver chains, long considered the gold standard (pun intended), now come with extra costs baked in.

So whether your chain was crafted in Shenzhen or Arezzo, you’re paying more at checkout.

Brand Breakdown: Who Raised Prices the Most?

Not every jewelry company handled the 2025 cost surge the same way. Our analysis showed three very different strategies:

-

ItaliaChains: This Italian-American brand kept prices as tight as possible. Even with tariffs on Italy, their 925 sterling silver chains saw around a 15–20% increase, much lower than the market average. They’ve positioned themselves as the “direct from Italy, wholesale price” option — and their customers have noticed.

-

Harlembling: Known for its moissanite jewelry and huge selection of hip hop chains, Harlembling raised prices only 10–15% across most sterling silver items. That’s well below the 42% market average. Translation? They likely absorbed some of the extra cost themselves rather than passing it all on to customers. Smart move to keep customer loyalty.

-

Ice Cartel: On the other hand, Ice Cartel treated the silver spike like a Black Friday sale — for themselves. Many of their pieces saw price hikes of nearly 100% year-over-year. A chain that was $200 in 2024? Now closer to $400. Customers aren’t thrilled, and reviews show complaints about feeling “ripped off.” When prices double while silver only rose 50%, that’s less economics and more opportunism.

Impact on Consumers: Shoppers Feel the Pinch

What does this mean for the average jewelry lover?

-

Chains & Bracelets: Expect to pay 30–50% more than you did last year, unless you shop from jewelers like ItaliaChains or Harlembling that absorbed some of the pain.

-

Pendants & Earrings: Smaller items increased less in raw metal cost but still carry higher retail tags due to tariffs.

-

Moissanite Jewelry: Stones haven’t gone up, but silver settings have — so the price bump still hits your wallet.

FAQs: Jewelry Prices in 2025

Q: Why did jewelry prices jump 42% in just one year?

A: Two main reasons — silver prices rose nearly 50% to $40/oz, and tariffs on both Chinese and Italian imports raised wholesale costs.

Q: Which jewelers handled it best?

A: ItaliaChains and Harlembling kept their price hikes much lower than average (10–20%), protecting their customers. Meanwhile, Ice Cartel nearly doubled prices, which has frustrated buyers.

Q: Is this price hike permanent?

A: Not necessarily. If silver prices cool off or tariffs are renegotiated, we may see stabilization. But for 2025, higher tags are the new normal.

Q: Should I still buy sterling silver jewelry in 2025?

A: Yes! It’s still more affordable than gold and platinum, and sterling silver retains value. Just be smart about where you buy.

Final Thoughts: Shining Through the Chaos

Jewelry in 2025 costs more — no sugarcoating it. A mix of skyrocketing silver prices and expanded tariffs has pushed up costs across the board. But not all jewelers treated their customers the same.

-

ItaliaChains kept their prices closest to wholesale.

-

Harlembling absorbed costs and only bumped prices moderately.

-

Ice Cartel? They saw the crisis as a cash grab.

If you want to save money and still rock real silver, stick with brands that put customers first. Because in 2025, jewelry doesn’t just reflect light — it reflects how much your jeweler values you.

Partager:

Who Owns Ice Cartel? The Truth About Joosep Seitam and His Dropshipping “Jewelry”

The Secret Source of Silver Chains: Where Harlembling, Luke Zion, Miabella & Others Get Their Shine